MADOOR, India — India’s rapidly growing private micro-credit industry faces imminent collapse as almost all borrowers in one of India’s largest states have stopped repaying their loans, egged on by politicians who accuse the industry of earning outsize profits on the backs of the poor.

|

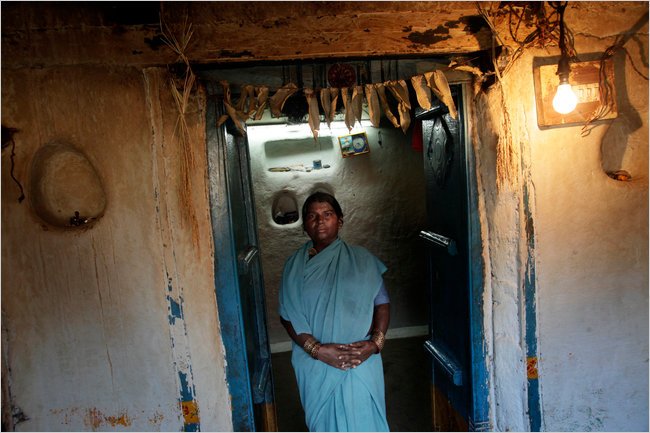

| Kuni Takahashi for The New York Times |

| K. Shivamma, a 38-year-old farmer in the Indian village of Madoor, is struggling to pay back a debt of almost $2,000 incurred through microloans. |

The crisis has been building for weeks, but has now reached a critical stage. Indian banks, which put up about 80 percent of the money that the companies lent to poor consumers, are increasingly worried that after surviving the global financial crisis mostly unscathed, they could now face serious losses. Indian banks have about $4 billion tied up in the industry, banking officials say.

“We are extremely worried about our exposure to the micro-finance sector,” said Sunand K. Mitra, a senior executive at Axis Bank, speaking Tuesday on a panel at the India Economic Summit.

The region’s crisis is likely to reverberate around the globe. Initially the work of non-profit groups, the tiny loans to the poor known as micro-credit once seemed a promising path out of poverty for millions. In recent years, foundations, venture capitalists and the World Bank have used India as a petri dish for similar for-profit “social enterprises” that seek to make money while filling a social need. Like-minded industries have sprung up in Africa, Latin America and other parts of Asia.

But micro-finance in pursuit of profits has led some micro-credit companies around the world to extend loans to poor villagers at exorbitant interest rates and without enough regard for their ability to repay. Some companies have more than doubled their revenues annually.

Now some Indian officials fear that micro-finance could become India’s version of the United States’ subprime mortgage debacle, in which the seemingly noble idea of extending home ownership to low-income households threatened to collapse the global banking system because of a reckless, grow-at-any-cost strategy.

Responding to public anger over abuses in the micro-credit industry — and growing reports of suicides among people unable to pay mounting debts — legislators in the state of Andhra Pradesh last month passed a stringent new law restricting how the companies can lend and collect money.

Even as the new legislation was being passed, local leaders urged people to renege on their loans, and repayments on nearly $2 billion in loans in the state have virtually ceased. Lenders say that less than 10 percent of borrowers have made payments in the past couple of weeks.

If the trend continues, the industry faces collapse in a state where more than a third of its borrowers live. Lenders are also having trouble making new loans in other states, because banks have slowed lending to them as fears about defaults have grown.

Government officials in the state say they had little choice but to act, and point to women like Durgamma Dappu, a widowed laborer from this impoverished village who took a loan from a private micro-finance company because she wanted to build a house.

She had never had a bank account or earned a regular salary but was given a $200 loan anyway, which she struggled to repay. So she took another from a different company, then another, until she was nearly $2,000 in debt. In September she fled her village, leaving her family little choice but to forfeit her tiny plot of land, and her dreams.

“These institutions are using quite coercive methods to collect,” said V. Vasant Kumar, the state’s minister for rural development. “They aren’t looking at sustainability or ensuring the money is going to income-generating activities. They are just making money.”

Reddy Subrahmanyam, a senior official who helped write the Andhra Pradesh legislation, accuses micro-finance companies of making “hyperprofits off the poor,” and said the industry had become no better than the widely despised village loan sharks it was intended to replace.

“The money lender lives in the community,” he said. “At least you can burn down his house. With these companies, it is loot and scoot.”

Indeed, some of the anger appears to have been fueled by the recent initial public offering of shares by SKS Micro-finance, India’s largest for-profit micro-lender, backed by famous investors like George Soros and Vinod Khosla, a co-founder of Sun Microsystems.

SKS and its shareholders raised more than $350 million on the stock market in August. Its revenue and profits have grown around 100 percent annually in recent years. This year, Vikram Akula, chairman of SKS Microfinance, privately sold shares worth about $13 million.

He defended the industry’s record before the India Economic Summit meeting, saying that a few rogue operators may have given improper loans, but that the industry was too important to fail. “Microfinance has made a tremendous contribution to inclusive growth,” he said. Destroying micro-finance, he said, would result in “nothing less than financial apartheid.”

Indian micro-finance companies have some of the world’s lowest interest rates for small loans. Mr. Akula said that his company had reduced its interest rate by six percentage points, to 24 percent, in the past several years as volume had brought down expenses.

Unlike other officials in his industry, Vijay Mahajan, the chairman of Basix, an organization that provides loans and other services to the poor, acknowledged that many lenders grew too fast and lent too aggressively. Investments by private equity firms and the prospect of a stock market listing drove firms to increase lending as fast as they could, he said.

“In their quest to grow,” he said, “they kept piling on more loans in the same geographies.” He added, “That led to more indebtedness, and in some cases it led to suicides.”

|

| Kuni Takahashi for The New York Times |

| D. Mallama spoke about her daughter, Durgamma, who ran away from her village in Andhra Pradesh, India, after not being able to pay back loans from microfinance agencies. |

One of India’s leading social workers, Ela Bhatt, who heads the Self-Employed Women’s Association, or SEWA, said micro-finance firms had lost sight of the fact that the poor needed more than loans to be successful entrepreneurs. They need business and financial advice as well, she said.

“They were more concerned about growth — not growth of the livelihoods and economic status of the clients, but only the institutions’ growth,” she said.

Mr. Mahajan, who is also the chairman of the Microfinance Institutions Network, said that the industry was now planning to create a fund to help restructure the loans of the 20 percent of borrowers in Andhra Pradesh who were struggling.

He also said the industry, which has been reluctant to accept outside help, would share its client databases with the government and was negotiating restrictions on retail lending that did not go through the nonprofit self-help lending groups.

The collapse of the industry could have severe consequences for borrowers, who may be forced to resort to money lenders once again. It is tough to find a household in this village in an impoverished district of Andhra Pradesh that is not deeply in debt to a for-profit micro-finance company.

K. Shivamma, a 38-year-old farmer, said she took her first loan hoping to reverse several years of crop failure brought on by drought.

“When you take the loan they say, ‘Don’t worry, it is easy to pay back,’ ” Ms. Shivamma said.

The man from Share, the company that made her first loan, did not ask about her income, Ms. Shivamma said. She soon ran into trouble paying back the $400 loan, and took out another loan, and then another.

Now she owes nearly $2,000 and has no idea how she will repay it. The television, the mobile phone and the two buffaloes she bought with one loan were sold long ago. “I know it is a vicious circle,” she said. “But there is no choice but to go on.”

Lydia Polgreen reported from Madoor, and Vikas Bajaj from Mumbai, India. Hari Kumar contributed reporting from Madoor.