30 Under 30 Finance:

Nathan Vardi, Forbes Staff / Source

Wall Street has long been a top destination for some of the best and brightest—and despite the credit crisis and recent turmoil in the financial sector that has not changed.

The Forbes 30 Under 30 Finance list is made up of men and women who are already making their mark at leading investment banks, hedge funds and other financial firms. Each one has attained tremendous responsibility at a young age and has a compelling story to tell.

Click image to view all - 30 Under 30: Finance

At the age of 29, for example, Jennifer Fan is already a Wall Street veteran. Now running her own $650 million hedge fund, Arbalet Capital, Fan has traded oil and gas in the aftermath of the collapse of Enron, the disruption of hurricane Katrina, the boom and bust of natural gas prices, and the shift to electronic trading. Fan arrived in Manhattan from Pittsburgh at the age of 16 to attend New York University. Within three years she had pocketed two degrees in finance and statistics. While interning at Bank of America as a teenager, Fan gravitated to commodities trading and at Morgan Stanley she learned to make bets on refined petroleum products like diesel and jet fuel.

Tracy Britt, 28, grew up on a farm in Kansas and struck up a relationship with Warren Buffett while at Harvard, contacting him out of the blue to see if he would meet with a non-profit group she co-founded focusing on investment education for undergraduate women. A few years later Britt moved to Omaha to become Buffett’s financial assistant at Berkshire Hathaway—and since then Britt has become chairman of Berkshire-owned companies Benjamin Moore and Larson-Juhl.

Jiayi Chen first met Steve Kuhn while taking Kuhn’s university class in Beijing. Kuhn recruited Jiayi to join him at Goldman Sachs and, later, to follow him to Pine River Capital Management, a $10.7 billion hedge fund firm where Kuhn is head of fixed income trading. Now 29, Jiayi is a Pine River partner and co-portfolio manager of the $1 billion Pine River Liquid Mortgage Fund, one of the best-performing hedge funds of 2012.

To be sure, mortgage trading has become one of the hottest corners on Wall Street. Joshua Bertman is a former Credit Suisse star mortgage trader poached in 2012 by Europe’s second biggest hedge fund. He is currently working in New York as a partner at Brevan Howard U.S. Investment Management, helping to grow the firm’s efforts in the mortgage arena.

The youngest financial up and comer on this year’s list is Sheel Tyle, who at age 21 is already working at his second venture capital firm, leaving Bessemer Ventures to join New Enterprise Associates after graduating from Stanford at the age of 19. Other venture capitalists on the list include John Locke, a vice president at Accel Partners, and Ray Bradford, an investment partner at Kleiner Perkins Caufield & Byers.

No firm has more people on this year’s 30 Under 30 Finance list than Goldman Sachs. The Wall Street firm’s rising young talent includes Lucy Baldwin, who at 28 is already a managing director, heading Goldman’s European retail and consumer equity research team, and is co-business leader of the equity research consumer business unit in Europe. Meanwhile, Andrew Silverman, 27, has emerged as a star credit derivatives and bond trader, working on Goldman’s distressed trading desk.

The finance business, of course, is a global industry. This year’s 30 Under 30 Finance list includes people working in London, like Jonathan Fayman, who co-runs a $1.3 billion macro hedge fund at BlueBay Asset Management and is originally from South Africa, and Manuel Stotz, who runs a $1.5 billion portfolio at THS Partners and is from Germany. Stefan Renold works for the LMR Partners hedge fund he co-founded in Hong Kong.

Who made the best deal of the bunch in 2012? Probably Joshua Kushner, whose $200 million private equity firm cashed in big on its investment in Instagram within hours, when it was sold to Facebook.

---------------------------------

| ||

|

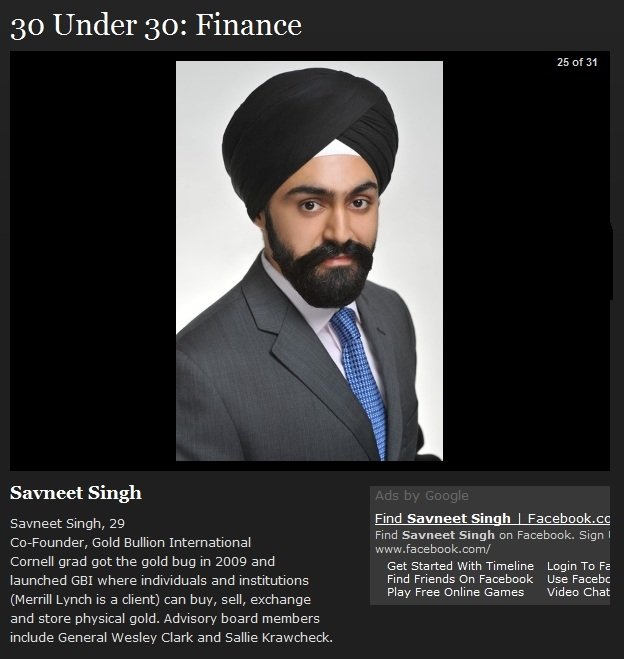

SOURCE Gold Bullion International LLC (GBI) Savneet Singh, President/Co-Founder Savneet Singh, 29, Co-Founder, Gold Bullion International Cornell grad got the gold bug in 2009 and launched GBI where individuals and institutions (Merrill Lynch is a client) can buy, sell, exchange and store physical gold. Advisory board members include General Wesley Clark and Sallie Krawcheck.Mr. Singh was an investment analyst at Chilton Investment Company where he covered investments in the technology, alternative energy and infrastructure space. Prior to Chilton, Mr. Singh was at Morgan Stanley in the investment banking division where he worked on large financial sponsor and strategic company transactions. Mr. Singh received his B.S. in Applied Economics and Management from Cornell University and currently serves on the boards of Ecologic Solutions and Stiki Digital. Savneet was recently named to the Forbes 30 under 30 list, in addition to the Empact 100 list of top 100 Entrepreneurs under 30.

Gold Bullion International (GBI) is a leading institutional precious metals provider to Individual Investors and the wealth management industry. GBI's technology platform allows clients to acquire and manage their precious metals assets directly through GBI or through their existing wealth management account relationships. Precious metals are acquired from dealers that sell London Bullion Market Association recognized brands and stored on behalf of clients in protected and insured vaults in New York, Salt Lake City, London, Zurich, Singapore and Australia. GBI is the safest and most reliable option for precious metals owners.

|

| Savneet Singh from Gold Bullion International shares thoughts on Davos and goldLink to article

David Walker

InvestmentEurope.net

February 3, 2012: Here, we place gold within the world economic, political and social context. World leaders from all walks of life have been gathering in Davos. It is important for them to realize that the current solutions that have been chosen to deal with the financial systems problems are easy, lazy solutions. The value of gold is rising because owners of capital realize that their capital is being debased by the world's authorities. Ultimately, gold is not just a commodity or a currency. It is an asset with links to power, wealth, political control, history, freedom, moral values and even the direction of culture. We are currently in a period where the world's monetary and fiscal authorities have chosen to debase their currencies, either by suppressing interest rates artificially (USA) or by actual policies forcing their currencies to weaken (Switzerland). The acknowledgement that debasement is a viable solution to problems that have grown over the past 30 years is now more or less acknowledged as the right and proper course of action. Each of the three main economic players on the stage (the US, Europe and China) currently maintain negative real interest rates and perform some sort of asset purchasing, asset support programs. Free market principles and the discipline that they bring with them are now gone from the scene. Answers to current economic problems, which themselves were brought on by excess and leverage, are now being solved with added leverage, tinkering and ultimately debasement. The problem today is not that the dollar has fiat status 'and can be printed up' as so many suggest. The problem is that the total corps of world economic and financial 'leaders,' who get together in remote ski villages, all believe in the same debasement programs. The 'everyone-is-doing-it-so-it-must-be-ok' mentality has prevented real thought from occurring. It killed what might be innovative policy responses to the current problems. Remarkably, even the ECB, the last holdout of the important central banks has finally succumbed to the world's pressure to monetize fiscal deficits. It is a gesture that is surely the most important in its 12 years of existence. The killing off of the last of the hard money policymakers (Axel Weber and co.) has almost guaranteed that systematic debasement will occur at an increasing rate and will lead to the continued erosion of savers' capital. Why is this erosion a bad thing? In the long run it encourages a certain type of morality...upon which almost every great fortune was ever built. Hard work, determination, foresight, savvy, and skill are all characteristics of the owners of capital. That is not to say that poor or unsuccessful people do not have such virtues, just that 'owners of capital' almost always have them. Debasement of currency - in essence the slow erosion of the value of capital - encourages one to think that saving, and in effect, hard work, in the creation of a lasting endeavor is not something that the culture places value upon. What is the point of working hard when the government will ultimately support you? And - even if you did work hard - it wouldn't matter because the actual money that you would eventually make would be losing its value by 2% a year in real terms or 4% a year if you lived in the UK. Bad personal habits are an unfortunate outgrowth of bad economic policy that usually go unrecognized. However, currency debasement also corrupts the leaders who support such policies. The idea that one can print one's own currency and then use that currency in the way that one likes is too much of a temptation for anyone. Behind such action ultimately lies the need for certain individuals to control the fate and well-being of the rest. Gold, of course, is not the answer to all the problems. It does, however, have a valuable role to play in limiting the degree of world currency debasement, while at the same time placing a check on political leaders who would want to spend money that isn't theirs, on whichever programs they like. Gold should stand as an alternative to the world's currencies. It is the only one that cannot be debased, devalued, defaulted upon or over taxed and easily confiscated. Unlike almost any other large forms of cash, it can be held outside the banking system and the purview of the federal authorities. While the accumulation of gold is hardly a creative or important life endeavor, it stands against the manipulation of central authorities, central banks or central governments. In recent years, odd as it may seem, one of the largest groups of gold buyers has been the central banks of the emerging world. Somehow, these countries, aware of the debasement programs of the US and Europe (and to some degree China as well) are eager to protect the savings they have accumulated, held in dollars and euros, over the past 10 years. It might be going too far to say that these central banks and their sovereign entities are repudiating, in a quiet way, the values propagated by reckless spending and currency debasement. However, as time goes on, and as they allocate more of their savings to gold and hard assets, they will see real wealth increases that are the benefit of their hard work, skill and determination. The co-authors of this report, Savneet Singh and Dan Tapiero, are the co-founders of Gold Bullion International. |

Gold’s importance has never been as great as it is today, relative to the limited understanding of why it is important.

Gold’s importance has never been as great as it is today, relative to the limited understanding of why it is important.